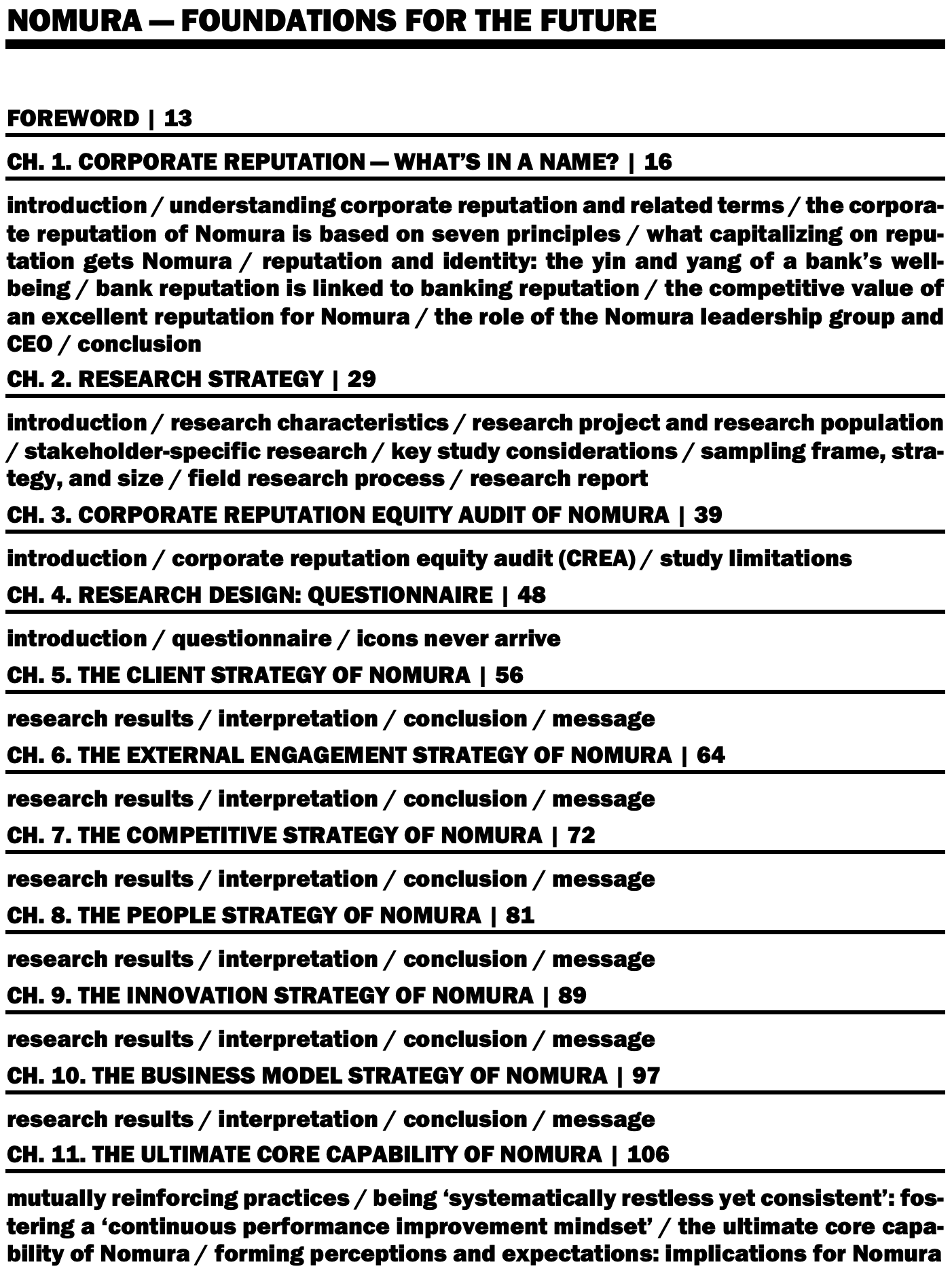

NOMURA — FOUNDATIONS FOR THE FUTURE (DATA ONLY EDITION 2026)

NOMURA — FOUNDATIONS FOR THE FUTURE (DATA ONLY EDITION 2026)

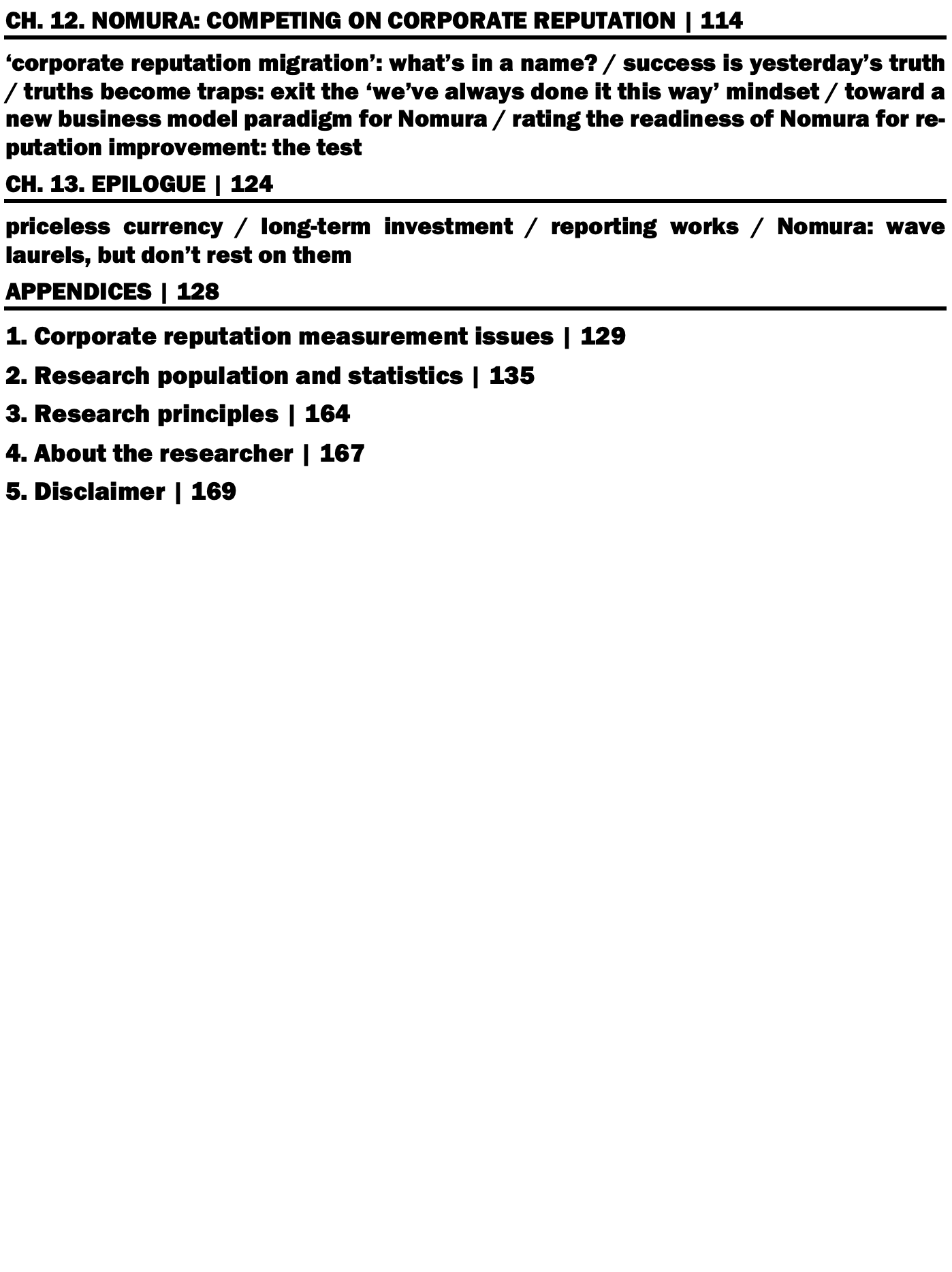

Size alone doesn’t define a bank’s reputation in wholesale banking (i.e., commercial, corporate, and investment banking). So, what does Nomura — Foundations for the Future reveals the wholesale banking reputation of one of Japan’s leading financial institutions. Based on extensive field research among 4,039 executives and senior managers from Fortune Global 500 and Forbes Global 2000 companies, this report offers an in-depth analysis of how Nomura is perceived in the industry. C-suite executives and senior managers evaluated Nomura’s wholesale banking performance across six dimensions: client-centricity, external engagement, competitiveness, leadership and employee quality, innovativeness, and business model efficiency and effectiveness (e.g., Nomura’s reliability as a business partner, its agility, client responsiveness, and resilience). In essence, banks like Nomura sell us status — they sell us their reputations.

This research report presents the ‘Data Only Edition’ for Nomura — Nomura’s research results. For those seeking an even deeper understanding of the drivers behind excellence in wholesale banking, seen through the lens of clients, I strongly recommend reviewing the ‘Extended Edition’ or ‘Extended + Edition’ of the Goldman Sachs report, Goldman Sachs — The Blueprint for Leadership. Ranked first in this extensive, multi-year study, Goldman Sachs received the most nominations, offering valuable insights for every leading bank — financial behemoth or boutique bank. While each bank faces unique challenges, the in-depth analysis of Goldman Sachs’ performance provides invaluable lessons applicable across the industry.